We know insurance can be confusing to navigate. We’ve created this glossary as an educational resource to help define some of the most common health insurance terms. Every insurance plan is different. Please note that these terms may have a slightly different meaning when used in your policy or plan. All pricing and percentages are to be used as an example and may differ from your actual coverage.

Coinsurance

Coinsurance is a percentage of a medical charge you pay, with the rest paid by your health insurance plan, which typically applies after you’ve met your deductible. For example, if you have 20% coinsurance, you pay 20% of each medical bill, and your health insurance will cover 80%.

Copay

A copay, or copayment, is a predetermined rate you pay for health care services at the time of care. For example, you may have a $25 copay every time you see your primary care physician, a $10 copay for each monthly medication, and a $250 copay for an emergency room visit.

Deductible

The deductible is how much you pay before your health insurance starts to cover a larger portion of your bills. In general, if you have a $1,000 deductible, you must pay $1,000 for your care out of pocket before your insurer starts covering a higher portion of costs. The deductible resets yearly.

Premium

The premium is the monthly payment you make to receive health insurance. You pay the premium each month like a gym membership, even if you don’t use the coverage. If you don’t pay the premium, you may lose your insurance. If you have employer-provided insurance, the company typically picks up part of the premium.

Out-of-pocket maximum

The out-of-pocket maximum is the limit of what you’ll pay in one year, out-of-pocket, for your covered health care before your insurance covers 100% of the bill. (This amount doesn’t include what you spend for services your insurance doesn’t cover.)

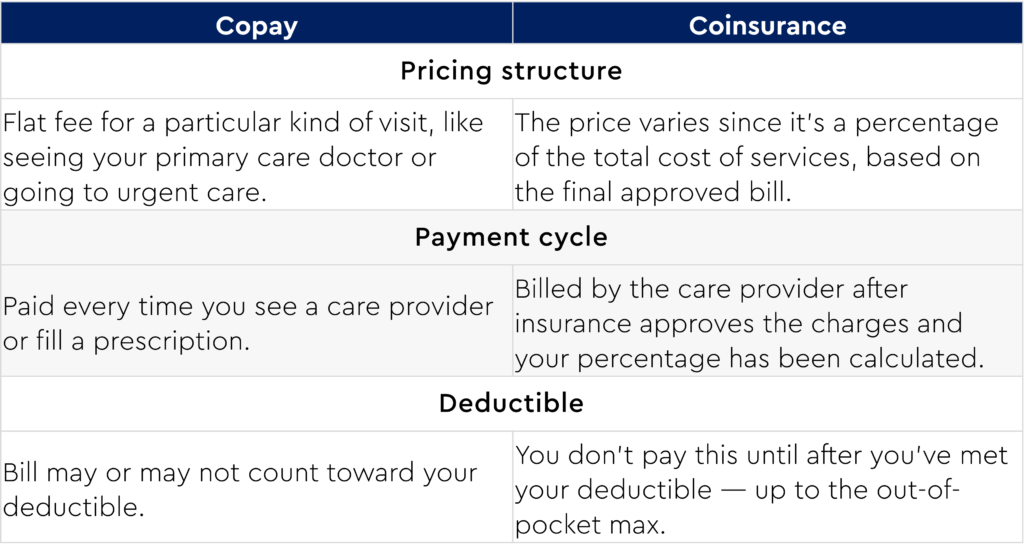

Coinsurance vs. copay

Copays and coinsurance are different ways your health insurance may require you to pay for covered services. Here are the differences:

Copay vs. deductible

Your health plan may have both copays and deductibles. Whether you pay one or the other may depend on the services you receive. For some services, such as a visit to your primary care doctor, you may owe a fixed copay, such as $10 or $20, for example. For other services, such as an MRI, you may have to pay the approved cost of the service up to your deductible.

Your copay may count toward your deductible, but it doesn’t always. And you may owe copays for some services after you meet your deductible.

Coinsurance vs. deductible

Deductibles and coinsurance work together, but usually consecutively. As mentioned, the deductible is the amount you pay before your insurance starts covering the cost of your health care. Once you meet your deductible, you’ll typically owe coinsurance (such as 20% of approved charges) on all additional services for the rest of the year.

You’ll pay coinsurance on approved medical care until you hit the out-of-pocket maximum on your plan, after which your insurance will cover 100% of the rest of your care for the year.

How it all works together

Health insurance policies can have a variety of cost-sharing options. For example, some policies have low premiums, high deductibles and high maximum out-of-pocket limits, while others have high premiums, lower deductibles and lower max out-of-pocket limits.

In general, it works like this:

- You pay a monthly premium to have health insurance.

- Then, when you see your provider or go to the hospital, you pay either full cost for the services or copays as outlined in your policy.

- Once the total amount you pay for services (not including copays) adds up to your deductible amount in a year, your insurer starts paying a more significant chunk of your medical bills, commonly 80%. The remaining percentage that you pay is called coinsurance.

- You’ll continue to pay copays or coinsurance until you’ve reached the out-of-pocket maximum for your policy. At that time, your insurer will start paying 100% of your medical bills until the policy year ends or you switch insurance plans.